GRESB is an internationally recognised benchmark assessing Environmental, Social and Governance (ESG) performance of real assets for listed property companies, private property funds, developers and investors that invest directly in real estate.

The Annual GRESB Real Estate Assessment survey now incorporates $4.8 trillion of real estate, covering over 1,200 property companies and more than 96,000 assets across 64 countries.

Over the past decade GRESB assessment has become one of the most widely used and recognized ESG benchmarks for real estate companies, developers, REIT and real asset funds.

GRESB reporting reflects the material issues in the sustainability performance of real estate investments as identified by investors. GRESB ranking reflects asset and portfolio sustainability.

What does GRESB measure?

The GRESB methodology comprises Management, Performance and Development Components. Existing buildings cover performance and management and those under development or renovation include development and management. Taken together these result in a GRESB score.

Performance

Portfolio performance, information collected at the asset and portfolio level. Suitable for real estate companies of funds with operational assets. Includes performance indicators e.g., energy consumption, GHG emissions.

Management

Strategy and leadership, policies and processes, risk management and stakeholder engagement, comprising of information collected at the organization level.

Development

Efforts to address ESG issues during design, construction, and renovation of buildings. Suitable for entities involved in new construction and / or major renovation projects, with on-going or completed projects during the reporting period.

Participants seek to demonstrate leadership, drive improvements, and monitor performance. Tracking your own progress and peer benchmarking are all made possible through the insights on performance.

When is the GRESB assessment conducted?

GRESB provides investors with actionable information and tools to monitor and manage the ESG risks and opportunities of their investments. The GRESB portal is open for submissions from April to the 1st of July, with the results being announced in autumn.

APAC GRESB response service includes

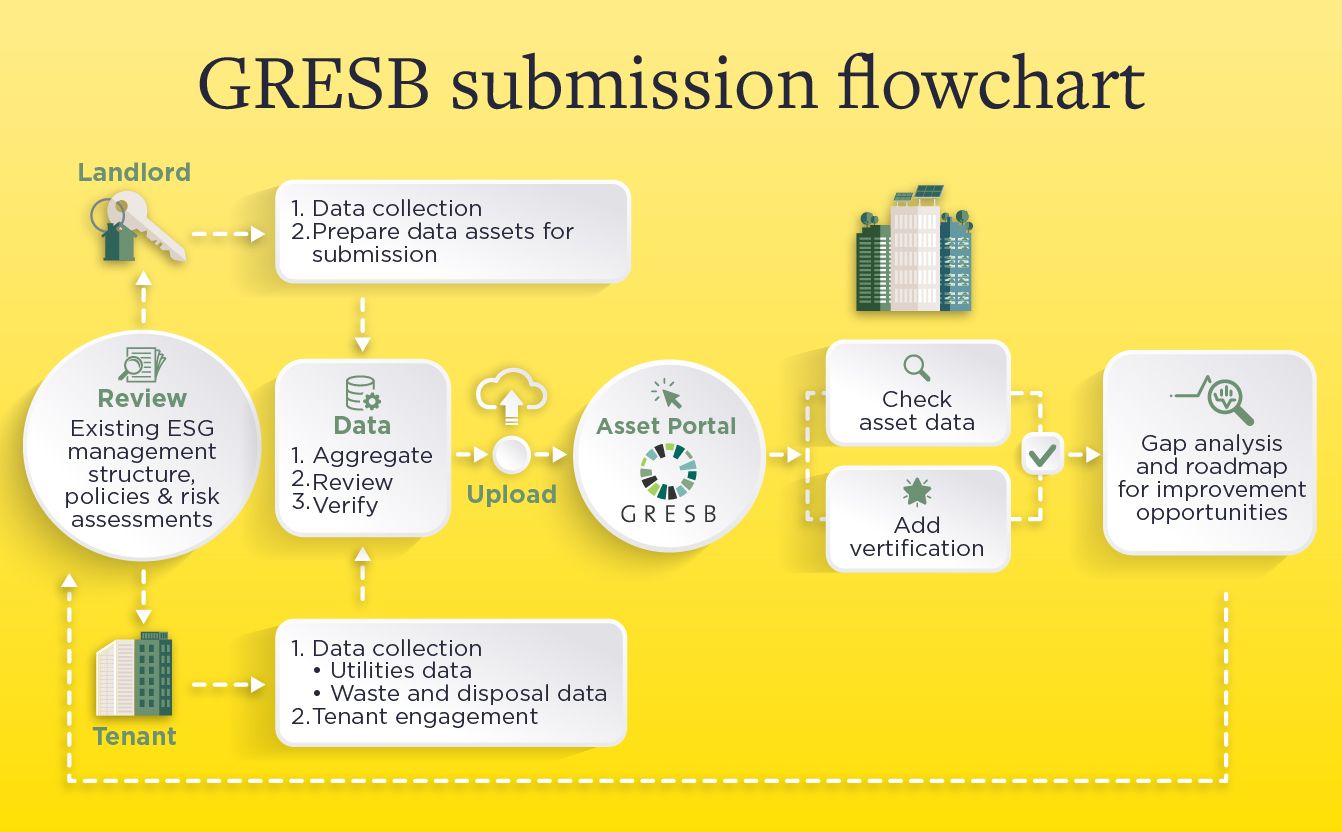

- Review of existing ESG management structure, policies, risk assessments and other management aspects against the GRESB submission criteria.

- Landlord data collection and preparation of datasets for submission.

- Tenant engagement and gathering of utilities and waste data.

- Data aggregation, review and verification.

- Data upload and checks on the GRESB portal.

- Preparation of the GRESB evidence pack.

- Results review and development of a roadmap for implementing improvement opportunities.

What are the benefits of participating in GRESB?

- Influences decision making that leads to a more low-carbon, resilient and sustainable future.

- Transparency for investors by providing standardised analytical tools to monitor ESG performance of their investments.

- Insights into the relative performance on ESG, helping to develop and communicate entity sustainability performance and credentials.

- Coverage of both entity and asset level aspects and across social, environmental and governance pillars.

- Alignment with international ESG reporting frameworks and guidelines, such as GRI and PRI.

- Additional services may include peer review, gap analysis and improvement plans.

Why Savills for GRESB?

Savills sustainability team has been delivering the GRESB response service since 2015. We provide participants with the resource and expertise required to submit a high-quality response to the GRESB Real Estate Assessment.

Our GRESB submission support is built upon a foundation of real estate and property management knowledge. We work closely with surveyors, property managers and all key stakeholders across the asset management chain. Our services includes supporting clients at both the strategic level and asset level of their ESG journey’s and we can help with the implementation of asset improvement plans, sustainability policies and initiatives to improve GRESB scores.

Download the GRESB real estate assessment document here

Download the Sustainability & ESG capability statement here